Where Data Meets Humanity

Our trusted brands, fueled by AI, ignite financial clarity for the next generation. We fuse data-driven insights with human expertise, empowering the transformation of complex financial information into actionable power.

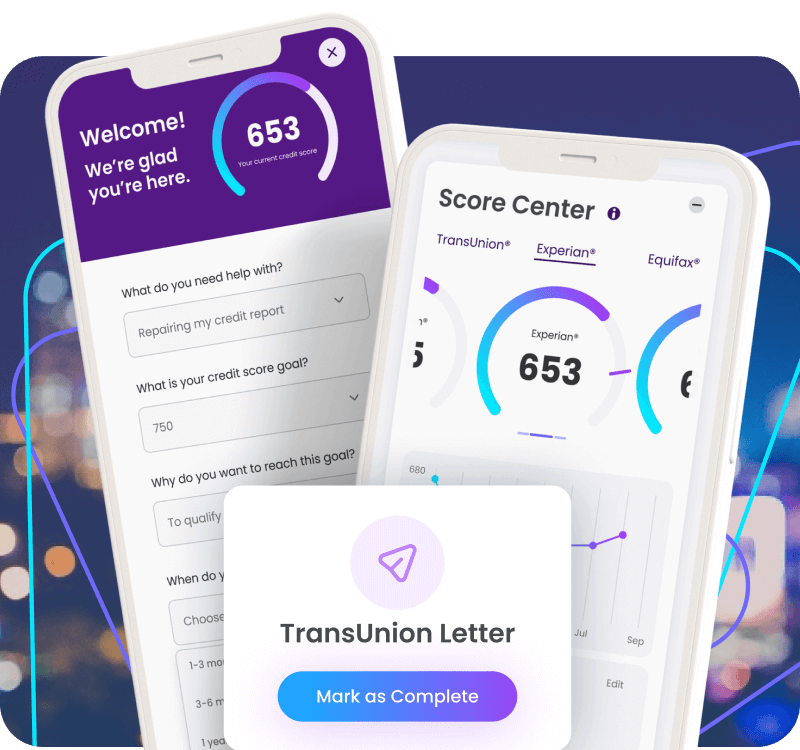

Credit Coaching & Debt Relief

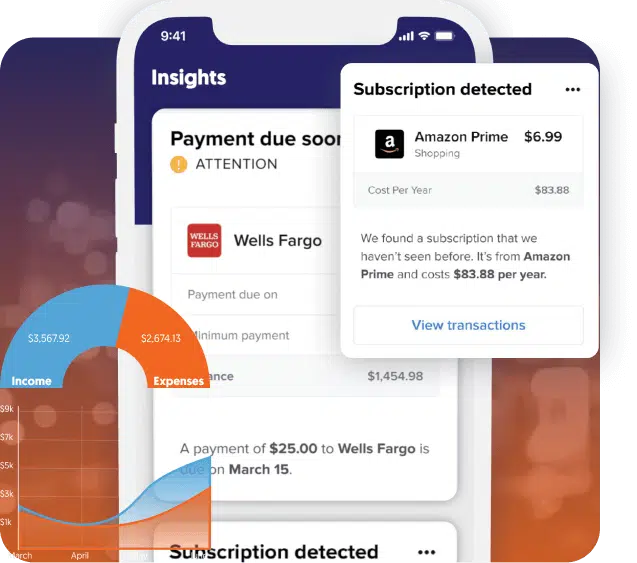

Find real money solutions and effective debt relief strategies with our credit and debt education-based membership platform. Sync accounts, talk to a financial coach, and utilize Money Sensei® AI technology for personalized budgeting tips to reach financial goals.

CRM Business-in-a-Box

This all-in-one customer relationship management (CRM) tool has everything you need to power your business. This easy-to-use platform consolidates costs and effort by allowing you to connect client reports with a single click, automate daily tasks, track client progress, and more. The best part – it’s free to IDIQ partners!*

*Free to financial coaches with at least five clients with an active IDIQ brand membership.

The IDIQ Ecosystem

Craft custom solutions using our financial ecosystem to empower your business needs and drive your clients to financial success.

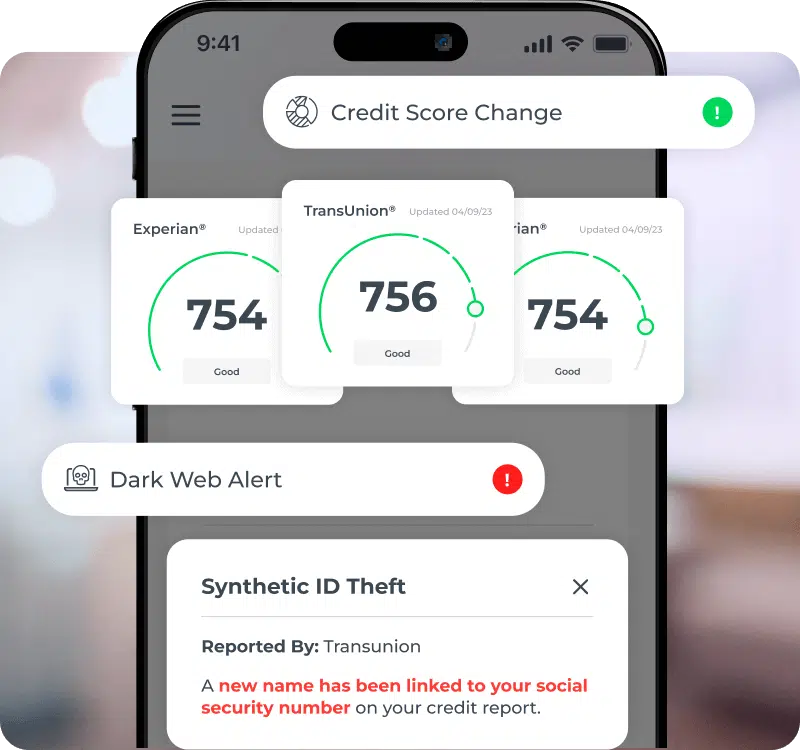

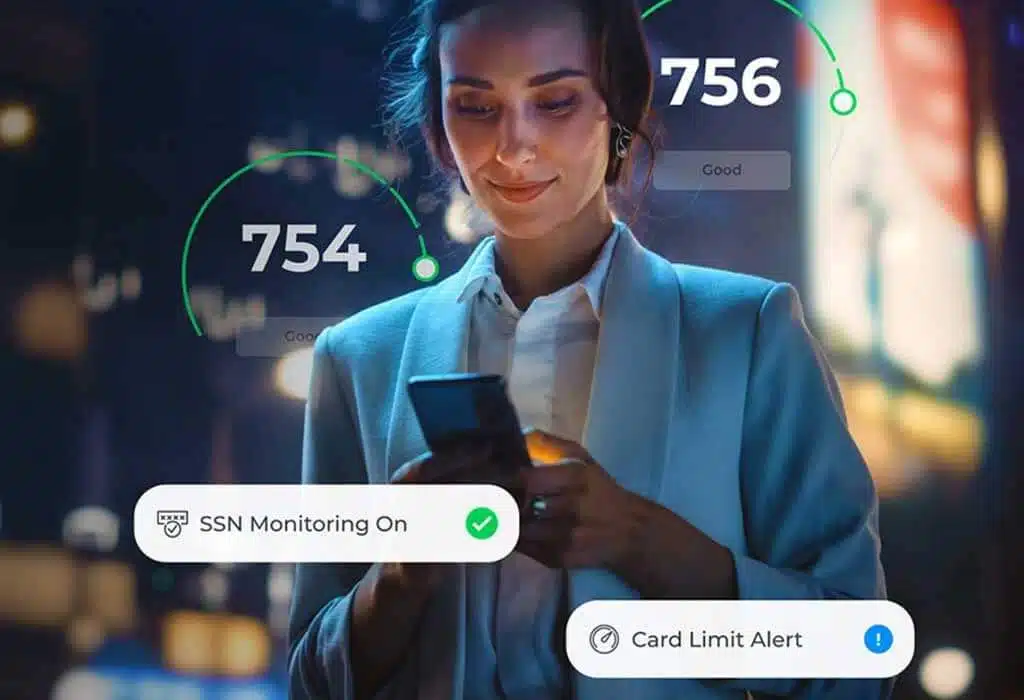

Identity Theft Protection

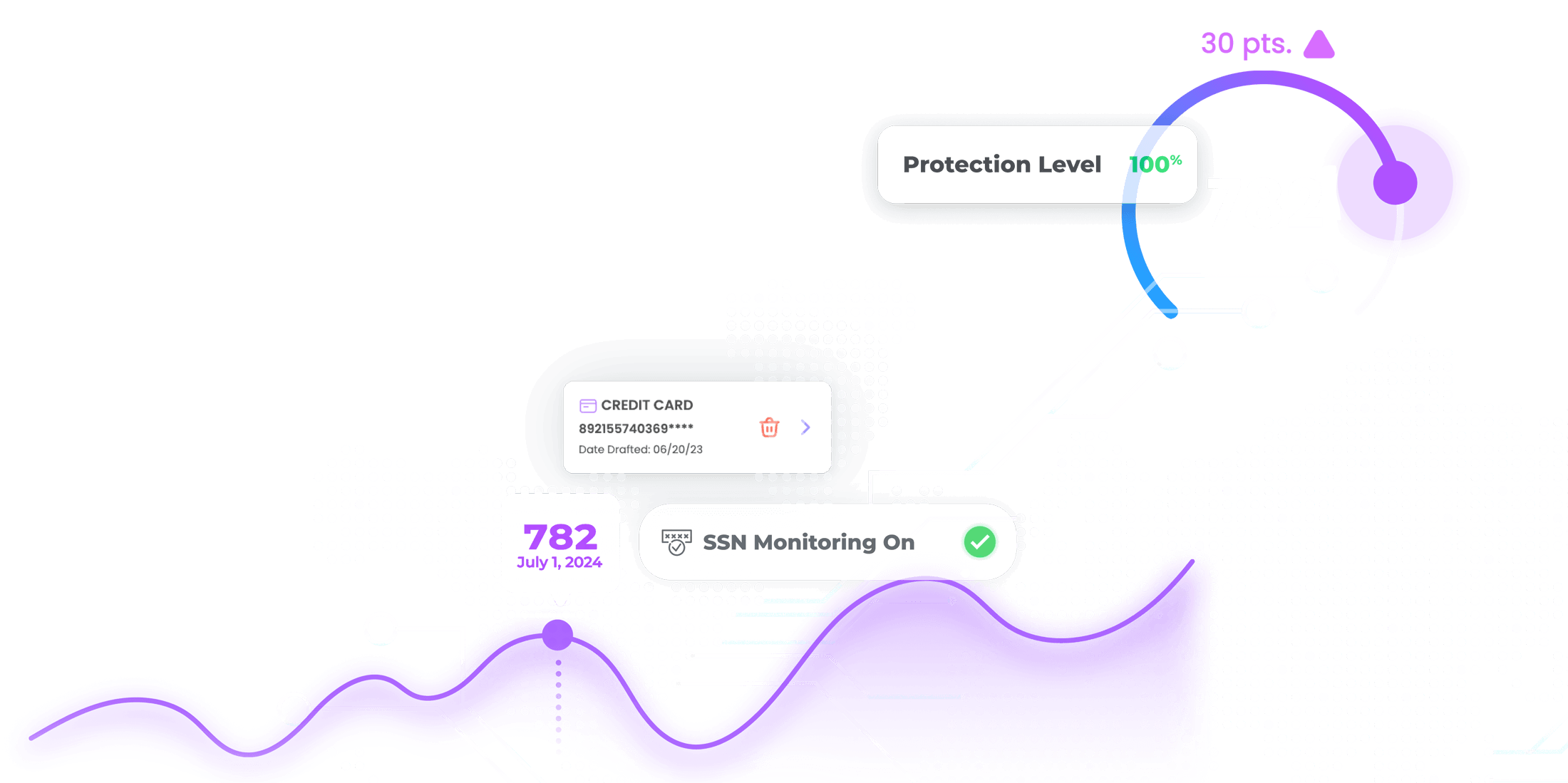

Safeguard your personal information with advanced monitoring and AI-powered alerts in over 35 categories.

Financial Wellness

Sync your accounts, talk to a qualified financial coach, explore debt relief strategies, and more!

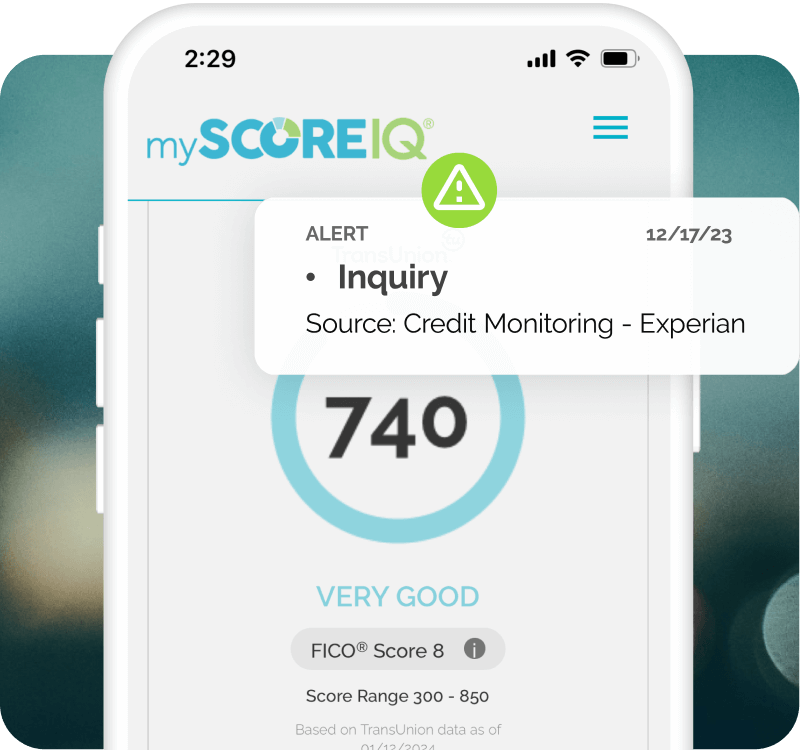

Credit Scores & Credit Monitoring

Real-time credit score alerts grant you control and insight into your financial future.

Legal Services

Navigate everyday legal challenges – from consultations to will preparation – for a fixed, affordable cost.

Unlock Your Growth Potential with Financial Intelligence

Decades of Broker Expertise. Benefits Revolutionized.

For decades, IDIQ has empowered brokers like you to deliver exceptional employee benefit packages. Our customizable suite goes beyond the ordinary, offering a comprehensive solution with industry-leading features such as financial wellness, identity protection, and pre-paid legal services. Streamline administration, reduce costs, and elevate your value proposition.

Retain Residents and Boost Your NOI With IDIQ.

Stop the revolving door of residents and unlock new revenue streams. Attract and keep quality tenants with resident-loved perks such as rental payment reporting, identity protection, and financial wellness programs. IDIQ minimizes your turnover costs while maximizing resident satisfaction and loyalty, leading to a healthier bottom line.

Grow Your Practice Faster with IDIQ.

In today's crowded legal landscape, IDIQ empowers firms to attract high-value clients and accelerate growth. Reach ideal clients through targeted lead generation and receive access to clients in need of a variety of services across the country. Partner with IDIQ and unlock the full potential of your legal practice.

Empower Clients. Grow Revenue.

IDIQ equips you to empower your clients on their financial journey, fostering trust and loyalty through industry-leading credit management resources. This translates to new revenue streams for you with commission opportunities. Partner with IDIQ and focus on what matters most - your clients' financial success and your company's growth.

Business Lending

Secure a competitive edge in lending with faster closings and lucrative commission opportunities.

Financial Institutions

Empower your members' financial well-being while boosting non-interest income and retention.

Advertising Partners

Tailored for content creators and online advertisers, our affiliate program can help grow your brand’s earning potential. Promote IDIQ brands on your website, blog, social media platforms, or other online space, and get paid for every qualified enrollment you send our way.

.jpeg)

IDIQ Partners with NCRA to Transform Rent Payments into Credit Building for Millions of Renters

Strategic alliance addresses critical gap for 44 million American renting households while creating new revenue and relationship opportunities for property managers

Temecula, CA, Sep. 17, 2025 – IDIQ®, a leading financial intelligence platform, today announced a strategic partnership with the National Consumer Reporting Association (NCRA) that will transform how millions of renters build credit. Through NCRA’s network of member agencies and their property management clients, renters nationwide will gain access to rent payment reporting services that will turn their largest monthly expense into a credit-building opportunity.

The partnership addresses a fundamental inequity in the credit system: while 44 million American households pay rent reliably each month, these payments traditionally provide no credit benefit, leaving renters at a disadvantage when seek loans, mortgages, or better interest rates.

“This partnership between IDIQ and the NCRA solves a massive markets problem,” said Nikki Boehle, Senior Vice President, Multi-Family Channel, at IDIQ. “Renters are already demonstrating financial responsibility through consistent rent payments. Now these payments will finally count toward building their credit history, opening doors to better financial opportunities such as access to loans and lower interest rates.”

Partnership Creates Triple Win Across Housing Ecosystem

The IDIQ-NCRA alliance delivers measurable benefits across the entire rental housing value chain:

For Renters: Monthly rent payments are securely reported to all three major credit bureaus, helping establish or strengthen credit history without taking on additional debt. Early data shows renters typically see meaningful credit score increases within months of enrollment.

For Property Managers: Rent payment reporting serves as a powerful differentiator in competitive markets while encouraging on-time payments and improving resident retention. Properties offering credit-building amenities report higher renewal rates and reduced turnover costs.

For NCRA Member Screening Companies: The partnership transforms one-time resident screening transactions into ongoing client relationships, creating new revenue streams while deepening property management partnerships.

Beyond Rent Reporting — Comprehensive Financial Wellness

This partnership extends beyond rent payment reporting to include IDIQ’s full financial intelligence suite. NCRA membership will offer residents access to IdentityIQ® for robust identity theft protection and CreditBuilderIQ℠ for personalized credit-building action plans, creating a comprehensive financial wellness platform.

This holistic approach addresses the growing demand from both renters and property managers for value-added services that support long-term resident success and retention.

“NCRA members help open doors to housing for consumers through their tenant screening services. It makes sense that we can further help those consumers once they are in their apartments through the NCRA/IDIQ partnership,” said Eric J. Ellman, President of NCRA.

Addressing Market Demand for Credit Access

The partnership comes as housing costs continue rising and credit access remains challenging for many Americans. Traditional credit building methods often require taking on debt, making rent payment reporting an attractive alternative for the millions of Americans who prioritize responsible spending over borrowing.

The service integrates seamlessly into existing property management workflows, with flexible enrollment options and automated monthly reporting to all three major credit bureaus.

For more information, visit www.IDIQ.com.

About IDIQ

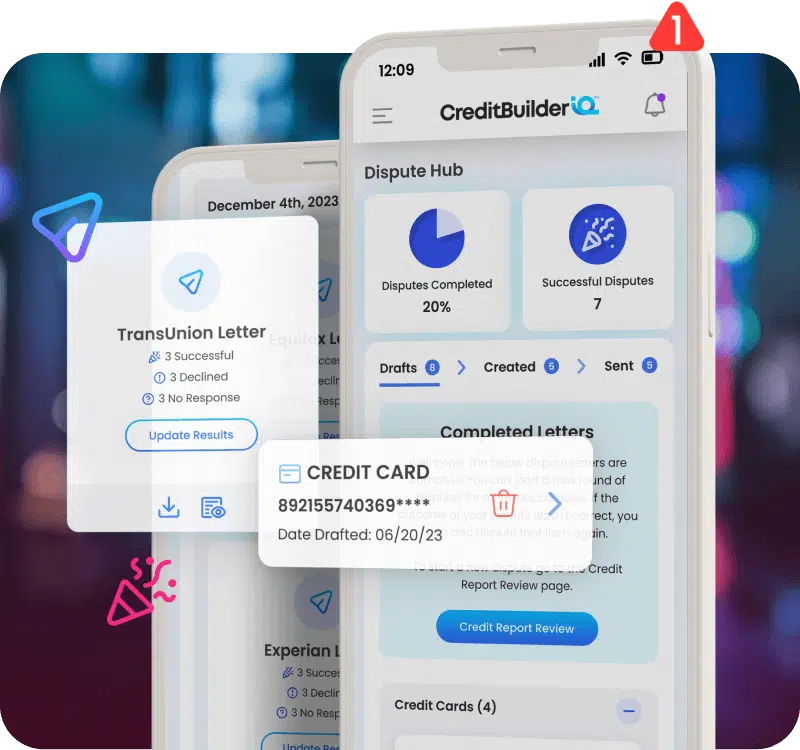

IDIQ® is recognized as one of the fastest-growing industry leaders in identity theft protection and credit report monitoring. The IDIQ flagship brand, IdentityIQ®, offers real-time fraud alerts and credit report information to both protect and educate consumers. Popular IDIQ brands also include MyScoreIQ® for financial health and protection; Credit & Debt®, a credit and debt education-based membership platform; and IDIQ® Pre-Paid Legal Services℠, a leading provider of voluntary employee benefits.

The CreditBuilderIQ℠ and CreditScoreIQ℠ brands for DIY credit-building innovative tools along with the all-in-one customer relationship management tool Disco℠ round out the IDIQ full suite of products.

About National Consumer Reporting Association (NCRA)

Founded in 1992, the National Consumer Reporting Association is a national trade organization representing consumer reporting agencies and associated professionals that provide products and services to hundreds of thousands of mortgage lenders and property managers, who utilize consumer reports in their housing decisions.

Media Contact:

Kristin Hudson

Cline Public Relations

(951) 397-7595

IDIQ Report Reveals Staggering Surge in Fraud and Emerging AI Scam Tactics

Flagship IdentityIQ brand publishes report on rise of utility account fraud, student loan scams, and stolen personal documents along with rising AI threats

Temecula, California, April 3, 2025 – IDIQ®, a financial intelligence company, today released its latest Fraud Trends Report under its flagship IdentityIQ® brand, revealing alarming increases in utility account fraud, student loan scams, and stolen personal document cases over the past year.

The report, based on proprietary data, highlights an astounding 1,033% surge in utility account fraud, an almost 500% increase in student loan scams, and a 46% rise in personal document theft leading to identity theft in 2024. The report also predicts a sharp escalation in AI-driven fraud tactics, including deepfake scams, AI-powered phishing, and automated robo-scammers.

"The rapid evolution of fraud, especially with AI-enhanced scams, is a growing concern for consumers and businesses alike," said Scott Hermann, CEO of IDIQ. "We are committed to staying ahead of these threats by leveraging cutting-edge technology to protect our members and educate the public on emerging risks."

The report details key fraud trends and how AI is reshaping fraud, making scams more convincing and harder to detect. Deepfake technology is being used to impersonate individuals, AI-powered phishing is creating hyper-personalized attacks, and robo-scammers are automating large-scale fraud efforts.

"As AI technology becomes more sophisticated, scammers are finding new ways to exploit it," said Michael Scheumack, IDIQ Chief Marketing & Innovation Officer. "It’s more critical than ever for consumers to stay informed, stay on top of their credit and personal information, and take proactive security measures."

The report also outlines steps consumers can take to help avoid fraud and safeguard their personal information, including:

- Regularly monitor credit reports to detect possible suspicious activity early.

- Verify requests directly by contacting the agency or business through official communication channels.

- Be wary of urgent requests that pressure for quick action, especially those involving money transfers or sensitive data.

For more insights and information, visit IdentityIQ.com.

About IDIQ:

IDIQ® is recognized as one of the fastest-growing industry leaders in identity theft protection and credit report monitoring. The IDIQ flagship brand is IdentityIQ®, offering real-time fraud alerts and credit report information to not only protect but also educate consumers. Popular IDIQ brands also include MyScoreIQ® for financial health and protection; Credit & Debt®, a credit and debt education-based membership platform; and IDIQ® Pre-Paid Legal Services℠, a leading provider of voluntary employee benefits.

The newly-launched CreditBuilderIQ℠ and CreditScoreIQ℠ brands for DIY credit-building innovative tools along with the all-in-one customer relationship management tool Disco℠ round out the IDIQ full suite of products. To download the new report, visit https://www.identityiq.com/2024-fraud-trends-report.

IDIQ Promotes Bryan Sullivan to President & Chief Financial Officer

— Seasoned Business Leader to Lead IDIQ’s Next Phase of Growth —

Irvine, California, March 13, 2025 – IDIQ, a leader in financial intelligence, has promoted Bryan Sullivan to the new role of President & Chief Financial Officer. Sullivan, who joined IDIQ in May 2021 as Chief Operating Officer and Chief Financial Officer, has been a key player in the company’s growth and success.

In his expanded role, Sullivan will continue to report directly to Scott Hermann, IDIQ’s Chief Executive Officer. He will focus on revenue growth within existing channels, expansion into new channel opportunities and transformational operations.

“Over the last three years I am proud of the platform we have built to become the leader in financial intelligence. I am honored to step into this expanded role and further drive the strategic growth and financial success of IDIQ,” Sullivan said. “This is an exciting time of innovation and expansion. I look forward to working with our talented team to provide our members with great service and the features and benefits that protect and empower their financial lives.”

Before joining IDIQ, Sullivan served as Executive Vice President and Chief Financial Officer at loanDepot, where he played a key role in acquisitions, capital financing, and expanding the company into one of the nation’s leading consumer finance platforms. Prior to loanDepot, he had senior leadership roles at PIMCO and Goldman Sachs. Sullivan has extensive expertise in fintech, financial services, data services, and real estate services with a strong command of how to build and grow businesses.

“Bryan has been an integral part of IDIQ, demonstrating exceptional leadership, vision, and dedication to the company’s growth and success,” said Hermann, CEO of IDIQ. “I’m confident that under Bryan’s continued leadership and expanded role, IDIQ will reach new heights as the financial intelligence industry leader.”

IDIQ, founded in 2009, is one of the fastest-growing companies in America, earning five consecutive spots on the prestigious Inc. 5000 List that has also featured Microsoft, Patagonia, Intuit and Under Armour as previous list honorees.

About IDIQ:

IDIQ® is recognized as one of the fastest-growing industry leaders in identity theft protection and credit report monitoring. The IDIQ flagship brand is IdentityIQ®, offering real-time fraud alerts and credit report information to not only protect but also educate consumers. Popular IDIQ brands also include MyScoreIQ® for financial health and protection; Credit & Debt®, a credit and debt education-based membership platform; and IDIQ® Pre-Paid Legal Services℠, a leading provider of voluntary employee benefits.

The newly-launched CreditBuilderIQ℠ and CreditScoreIQ℠ brands for DIY credit-building innovative tools along with the all-in-one customer relationship management tool Disco℠ round out the IDIQ full suite of products. For more information, visit www.IDIQ.com.

Media Contact:

Kristin Hudson

Public Relations, IDIQ

951.397.7595

khudson@idiq.com

IDIQ Launches Comprehensive New Website for IdentityIQ Brand with Enhanced User Experience and Updated Features

Redesigned site for financial intelligence flagship brand also features new benefits, services, and resources to empower consumers to control and manage their financial lives

TEMECULA, CA – Jan. 9, 2025 - IDIQ®, a leader in financial intelligence, announced today the launch of the completely redesigned website for IdentityIQ®, the company’s identity and credit protection brand.

Perfectly timed to coincide with the New Year and a new focus on financial wellness, the new site has a modern look, cutting-edge tools, and was designed with an exceptional user experience in mind. The reimagined site also showcases how IdentityIQ services go beyond identity and credit protection and focuses on overall financial intelligence. Features and benefits include rent and utility payment reporting to major credit bureaus, device security, legal protection, financial management tools, and more.

“Our new website reflects our goal to empower consumers to take control of their financial lives. It represents a significant step forward in how we are connecting with our users,” said Scott Hermann, CEO of IDIQ. “We’ve reimagined every element of our site so that it’s easier than ever for users to access the tools, resources, and information they need to help safeguard their identity and credit. This redesign reaffirms our commitment to creating a seamless and user-focused journey.”

The new IdentityIQ website introduces exciting updates that include:

- Customized Consumer Journey: Purpose built to allow members to focus on financial intelligence benefits that matter most to their individual needs

- Refreshed Look: A sleek new design tailored to help users find what they need – quickly and easily

- Enhanced Product Imagery: Visually rich representations of dashboards and widgets, bringing the IdentityIQ experience to life

- Simplified Navigation: A streamlined layout that makes exploring our products and services easier than ever

- Expanded Resources & Education: News and alerts along with a comprehensive library of case studies, reports, blog articles, and more to help users make informed decisions

Visit www.IdentityIQ.com to see the redesign in action and discover how our enhanced tools and services can help you take control of your identity and credit protection.

About IDIQ

IDIQ® is recognized as one of the fastest-growing industry leaders in identity theft protection and credit report monitoring. The IDIQ flagship brand is IdentityIQ®, offering real-time fraud alerts and credit report information to not only protect but also educate consumers. Popular IDIQ brands also include MyScoreIQ® for financial health and protection; Credit & Debt®, a credit and debt education-based membership platform; and IDIQ® Pre-Paid Legal Services℠, a leading provider of voluntary employee benefits.

The newly-launched CreditBuilderIQ℠ and CreditScoreIQ℠ brands for DIY credit-building innovative tools along with the all-in-one customer relationship management tool Disco℠ round out the IDIQ full suite of products. For more information, visit www.IDIQ.com.

Media Contact:

Kristin Hudson

Public Relations, IDIQ

951.397.7595

khudson@idiq.com

What To Do if Your Small Business Has a Data Breach

Running a small business is no small task. Between managing employees, covering expenses, and keeping customers happy, you’re already wearing a variety of hats.

And now you have to add data breach management to the list? Unfortunately, in today’s digital world, cybersecurity threats are a reality small business owners can’t ignore.

Cybercriminals have shifted their focus to smaller, more vulnerable organizations. In fact, 82% of ransomware attacks now target smaller businesses, which often lack the resources, employee training, and safeguards that larger corporations have. That makes them easier targets.

When a data breach occurs, the consequences can be devastating. Up to 60% of small businesses that are targeted in a cyberattack go out of business within six months.

It’s a terrifying statistic, but here’s what matters: in the event of a data breach, there are tried and true steps you can take to mitigate your losses, meet your obligations, and start rebuilding trust with your customers.

In this article, we’ll walk you through what to do immediately following a breach, so that you can get back to business with confidence.

Why Small Businesses Are Prime Targets for Cybersecurity Attacks

In 2023 alone, 350 million people were affected by data breaches. And while cybersecurity attacks can affect companies of any size, small businesses are disproportionately affected.

According to the Verizon Data Breach Investigations Report, small businesses account for 43% of all data breaches.

Unfortunately, many of those small businesses are underprepared. A recent study revealed that nearly one quarter of small businesses have no device security, and one in three rely on free or basic solutions that may not offer strong security coverage.

On top of that, many small businesses also admit that their teams are inadequately trained to spot and stop cyberattacks before they spread.

To make matters worse, hacker tactics continue to evolve. From malware to phishing emails, cybersecurity for small businesses continues to get more complex. The chart below shows the most common cyber risks in 2025, including data breaches:

| Cybersecurity Threat | What It Is |

|---|---|

| Data Breaches | Hackers may gain unauthorized access to sensitive data such as customer records, payment details, or internal files. |

| Phishing and Social Engineering | Scams where attackers may pose as trusted contacts through email, texts, or calls designed to trick your staff into revealing sensitive information. |

| Malware and Ransomware | Malicious software that can disrupt your software systems, steal company data, or lock files until you pay ransom. |

| Weak Passwords | Shared or reused passwords that are easy to guess through manual or automated attacks. |

| Outdated Software | If you rely on older systems or apps with known flaws or vulnerabilities, hackers may be able to easily gain access. |

| DDoS Attacks | Hackers may flood your website with fake traffic until it’s too slow to use. |

| Man-in-the-Middle Attacks | Cybercriminals may intercept communications between your employees, or staff and customers to steal or change information. |

| Staff Errors | If your team or contractors mishandle files or share credentials, hackers can easily gain access. |

Clearly, there’s plenty of risk to contend with. Without rigid data breach prevention tactics in place, small businesses stand to lose a great deal, and the repercussions can be devastating.

The cost of a small business data breach can vary, but recent research shows cybersecurity incidents can cost small businesses an average of $2.98 million.

Small business data breach statistics are sobering, but there is hope. If your business experiences a data breach, acting quickly is the only way to prevent further damage and protect against long-term fallout.

The First 24 Hours Following a Data Breach: Containment Matters Most

When a data breach occurs, time is your most valuable asset. Waiting even a few hours to begin managing the situation can significantly increase the damage, and in many cases, the clock has already been ticking by the time you discover the problem.

According to IBM research, it takes an average of 277 days to identify and contain a data breach, largely because many go undetected for long periods. Larger organizations typically discover breaches faster than small organizations because they have strong, established cybersecurity practices.

Unfortunately, many small businesses find themselves unprepared to respond quickly, with half of small businesses reporting it took 24 hours or longer to recover their website after a cyberattack.

However, according to an IBM Data Breach Report, businesses that are able to contain a breach within 30 days can save over $1 million, so the sooner you can respond to a data breach, the better.

The Federal Trade Commission (FTC) recommends critical first steps when a small business data breach occurs.

1. Secure Your Business Quickly

As soon as you’re aware of a breach, focus on containment:

- Hire a data breach response team like IDIQ quickly

- Lock down any affected systems or physical areas

- Remove any exposed information from your website, then request removal from third-party websites or search engines

- Update passwords and any other access credentials

Taking these actions in the first 24 hours limits additional exposure and sets the foundation for recovery.

2. Consider and Address Vulnerabilities

Containing a small business data breach is only the first step, but understanding how it happened is just as critical.

Small businesses often rely on external providers for payroll services, IT support, and other key tasks that they can’t manage internally, meaning vendors could be a significant vulnerability. In fact, a recent study found that 35.5% of breaches in 2024 involved third-party vendors with access to sensitive data.

Review the information your vendors have access to and adjust or revoke privileges as necessary. Be sure you trust their security processes (and verify they make any necessary changes if they were responsible for the breach) before continuing your partnership.

Your Legal Obligations & Notifications

Every state has its own rules regarding how and when a business must notify customers after a data breach. Most require businesses to notify affected individuals within 30 to 60 days. Failing to do so can result in steep fines and lawsuits, and the loss of your customers’ trust.

IT Governance USA offers state-by-state data breach laws so you can understand exactly what’s required in your area.

IDIQ’s data breach response services help take care of breach notification requirements, helping you stay compliant while protecting your business and customers.

Use Identity Theft Protection

While not a legal requirement, adding identity theft protection services can help you better support your customers.

IDIQ’s identity theft protection services provide real-time monitoring, dark web scanning, and fraud restoration services for comprehensive support.

By giving your customers a proactive solution, you can reduce both the cost of the breach, improve customer sentiment, and make the experience less overwhelming.

Communicating a Data Breach to Your Customers

When a data breach occurs, your customers can face some of the worst fallout. Up to 87% of small businesses hold sensitive customer data, ranging from addresses to credit card details, that could be exposed in a breach.

The trickle-down effect of a data breach can impact customers in more ways than one. In 2023, 60% of companies that suffered a data breach were forced to raise their prices to recoup their losses. This means consumers don’t just deal with having their information exposed, but can end up paying the price even long after the breach is over.

When you notify your customers, be sure to let them know:

- What happened and when it occurred

- The data that was (or may have been) exposed

- The steps you’ve already taken to contain the breach

- What your customers can do to protect themselves, such as credit monitoring or identity theft protection

- How you’ll keep them updated moving forward

Be honest and transparent. Share real details, don’t downplay the situation, and let your customers know how your data breach response plan provides them with ongoing protection.

This type of clear, transparent communication shows accountability and can prevent long-term damage to customer trust.

Preventing Your Next Data Breach

There are key steps you can take to prevent future data breaches. The FTC offers 10 simple steps for small businesses to consider:

- Train employees: Up to 47% of businesses with less than 50 employees report having no cybersecurity budget, meaning staff mistakes can quickly turn into unintentional but costly incidents. Create a clear set of rules for passwords and handling sensitive information.

- Protect devices from cyberattacks: Ensure software, browsers, and operating systems are up to date. Run antivirus scans to spot problems quickly.

- Use firewall security: Enable firewalls on all systems to block unauthorized access.

- Consider mobile devices: If your team needs to use mobile devices for work, require password protection, encryption, and security applications. Create a process to report lost or stolen equipment.

- Back up your data: Implement automatic, regular backups of essential files and store them offsite or in a protected cloud network.

- Control access to information: Restrict access to business computers or data, set up individual user accounts with passwords, and limit admin privileges to only essential staff.

- Secure your Wi-Fi: Hide and password-protect Wi-Fi networks to prevent outside access.

- Protect company credit cards: Use anti-fraud tools and isolate your payment systems from general internet use.

- Limit employee access to data: Give employees access only to the tools and/or data essential for their role.

- Strengthen passwords and authentication: Weak or stolen passwords account for 80% of hacking incidents. Require your team to regularly update their passwords and use multi-factor authentication (MFA) for an added layer of security.

How IDIQ Can Help You Navigate a Data Breach

A data breach can be devastating for a small business, but how quickly you respond helps determine how your organization recovers. That’s why IDIQ provides comprehensive data breach response plans designed to move quickly.

With advanced monitoring and around-the-clock support for your team members, employees, or customers who have had information exposed in a data breach, you can rest assured you have the help you need to stop the spread of a data breach when you need it.

With IDIQ, you gain access to:

- 24-Hour guaranteed response time, so you get the help you need as fast as possible

- Customized recovery plans built for your business

- Dedicated support so you get the best care tailored to your unique needs

- Customer notification support to help you manage notifying affected people

- Identity theft protection services to help protect affected customers and employees

With nearly two decades of cybersecurity experience, IDIQ can help you navigate the stress, legal obligations, and end-to-end tasks necessary to protect your brand and your customers.

Reach out to IDIQ’s data breach response team today for the support you need to take back control.

What to Do After a Data Breach: Data Breach Management Guide

The growing frequency of cyberattacks has made effective data breach management critical for businesses. According to a report by the Identity Theft Resource Center, data breaches impacted more than 350 million people last year.

When a data breach occurs, the most important thing on any business owner’s mind is what to do next, and how to take action as quickly as possible.

With sensitive consumer data at stake, knowing the proper steps to take immediately after a breach can mitigate damage, restore trust, and help your business comply with legal obligations.

💡Related: What to Do if Your Small Business Has a Data Breach

What to Do Immediately After a Data Breach

The first few hours and days following a breach are critical to effective data breach management. Delays can lead to greater data loss, regulatory penalties, and a loss of trust from customers and stakeholders.

Below are the immediate steps businesses should take when a breach is detected.

Pro tip: Add these steps to your data breach management plan so you can be prepared.

Contain the Breach

The first priority after discovering a data breach is to contain the issue to help prevent further losses. If you don’t have a containment plan in place, here are some key steps you should take:

- Isolate affected systems immediately

- Shut down compromised servers and networks

- Disconnect the breached systems from the internet and other connected systems

- Restrict access to critical infrastructure

It's crucial to notify your IT team and cybersecurity professionals immediately so they can assess the situation, stop active threats, and prevent them from spreading further.

⭐️ Read More: Data Breach Statistics Reveal 26 Reasons Businesses Need Protection Now

Assess the Damage

Once the breach is contained, it’s time to assess the scope and impact of the attack.

Conduct a thorough investigation to understand the nature of the breach and what kind of data was compromised – whether it was customer information, financial records, or other sensitive data. Work with cybersecurity experts to determine how the breach occurred, which systems were affected, and if sensitive data was accessed or stolen.

Understanding the extent of the damage will help shape your data breach recovery plan and inform communication with affected parties.

Data Breach Legal Obligations & Regulatory Compliance

A key part of data breach management is understanding and adhering to the relevant data breach notification laws. These laws vary by state and dictate how and when businesses must notify affected parties.

Understanding Data Breach Notification Laws

In the aftermath of a data breach, businesses must notify their customers to comply with data breach notification laws, which vary by state.

These laws typically require companies to notify affected customers and regulatory authorities within a certain time frame. Companies may face penalties or lawsuits for failing to notify stakeholders in a timely manner.

For specific guidelines by state, contact the IDIQ Data Breach Response Team.

Engaging Legal Counsel

Legal assistance is a critical component of a data breach response plan. Attorneys can make sure that your business complies with federal and state laws and help protect you from further legal exposure.

They will guide you through liability considerations, particularly if customer data was involved, and ensure that the proper evidence is preserved for potential investigations. Legal professionals can also help you prepare a formal response for regulatory authorities and draft necessary communications to customers.

Post-Data Breach Communication Strategy

Handling the communication process effectively, both internally and externally, is critical to maintaining trust and minimizing confusion. Every organization needs a clear communication strategy as a part of its data breach management plan to avoid panic and misinformation.

Internal Communication

It is essential to inform key stakeholders within the company – including executives, legal teams, IT, and PR – without causing unnecessary panic. Clear communication channels ensure everyone is aligned on the response effort.

When notifying employees, be transparent but cautious about sharing specific details of the breach until more information is available. Stress the importance of maintaining confidentiality to prevent misinformation or further escalation.

External Communication

When communicating about a data breach externally, transparency is critical. Follow all state laws while informing those affected.

Businesses should outline what data was compromised and what steps are being taken to rectify the situation.

Offering resources such as identity theft protection services through partners like IDIQ can help rebuild trust and provide valuable support to affected customers.

Learn more about our comprehensive data breach solutions.

Data Breach Remediation and Security Enhancements

After the initial breach has been managed and communicated, businesses must focus on breach remediation efforts and enhancing their cybersecurity infrastructure.

Fix the Vulnerabilities

Once the breach is contained and initial communications are handled, the next step is to fix the vulnerabilities that allowed the breach to occur.

This might involve patching software, resetting passwords, disabling compromised accounts, updating firewalls and antivirus programs, or training employees.

Conduct a full security audit to detect lingering threats and to help make sure that no further damage occurs, and prevent data breaches from happening again.

Strengthening Cybersecurity Infrastructure

In the long term, businesses must make a continuous effort to strengthen their cybersecurity infrastructure to help prevent future breaches.

Here are some key steps you can take right away:

- Implement multi-factor authentication (MFA) to secure access to sensitive systems.

- Encrypt sensitive data to reduce the risk of exposure.

- Schedule regular security tests to identify vulnerabilities

Many businesses also turn to cyber insurance or data breach insurance to help cover costs associated with a data breach, such as legal fees and recovery efforts.

A comprehensive data breach response plan should also be developed and continuously updated to help make sure the company is prepared for future incidents.

Monitoring and Post-Breach Evaluation

A thorough post-breach evaluation is an essential part of long-term data breach management. This will help your business identify weaknesses and prevent future incidents.

Continuous Monitoring

After a data breach, businesses should closely monitor their systems for signs of lingering threats and potential cyberattacks.

Continuous monitoring and real-time threat detection solutions can help identify unusual activity before it escalates into another breach. This helps businesses respond faster and more effectively to potential data breaches.

Review and Learn

Conducting a post-breach review can help your company learn what went wrong and how to help prevent similar incidents in the future.

What were the weak points in your security? How effective was your response? Were there communication gaps?

Lessons learned from this review can guide future investments in employee training on cybersecurity best practices, ensuring the entire organization is prepared to detect and respond to potential threats.

Leveraging Identity Theft Protection Services

If your business collects sensitive consumer data, offering identity theft protection services as part of your data breach response plan can demonstrate goodwill and help protect your customers from further harm.

Identity theft protection services offered by IDIQ can monitor personal information, provide fraud alerts, and offer restoration services, helping businesses and customers in their data breach recovery.

💡 Related: 10 Tips for Data Breach Prevention

Bottom Line

A data breach can be devastating for any business, but how you respond can make all the difference in the future of your company.

By taking immediate action and following the steps outlined above, your company can recover from the data breach quickly and get back to business as usual. Strengthening cybersecurity measures and learning from the breach will help prevent future incidents.

Your business can recover faster with comprehensive data breach response services from IDIQ. From meeting all of your needs through customized recovery plans and guaranteed 24-hour response time to helping restore customer trust through identity theft monitoring, IDIQ can help protect your business and your customers in the event of a breach.

Don't wait — contact IDIQ for comprehensive data breach recovery services to protect your business today.

IDIQ is a financial wellness company. IDIQ does not provide legal advice. The information on the website is not legal advice and should not be used as such.

Protecting Your Clients in the Age of Evolving Fraud: Key Trends and Predictions

Each year fraud grows more complex, targeted, and difficult to detect. The IdentityIQ 2024 Fraud Trends Report with Predictions for 2025 reveals a staggering surge in scams fueled by traditional tactics and evolving technology such as artificial intelligence (AI). For businesses, understanding these trends is critical – not only to defend against fraud but to help safeguard clients’ trust and security.

IDIQ recently released its newest report, under the flagship IdentityIQ® brand and built on proprietary member data, on the key fraud trends found last year with predictions for this year to help consumers and businesses stay ahead of scams.

Click here to download the report.

Utility Account Fraud: Costing Customers and Companies

Utility account fraud exploded by more than 1,033% in 2024 compared to the previous year, marking one of the fastest-growing types of identity theft. Fraudsters typically use stolen personal information to open utility services in someone else’s name. Or, they impersonate utility providers and threaten disconnection unless an immediate payment is made.

What This Means for Businesses: If you serve customers who use personal data to access services – whether utilities, telecom, or other services – this trend should be on your radar. Fraudsters are now bypassing consumers and targeting service providers directly through fake accounts, payment fraud, or account takeovers.

It’s important to help educate clients about verifying payment requests and only contact organizations through official channels.

Student Loan Scams: Preying on Financial Stress

Student loan-related fraud jumped by almost 500% in 2024 compared to the previous year. With the resumption of student loan payments post-pandemic, scammers used confusion and misinformation to launch fake forgiveness programs, phishing emails, and identity theft scams.

What This Means for Businesses: Fraudsters exploit communications to steal data, pretending to be businesses and using corporate logos to mimic real businesses.

Businesses can help educate clients about known scams and how to verify communication to help avoid these scams.

The Comeback of Physical Document Theft

While digital threats are rising, physical document theft saw a 46% increase last year compared to the previous year. Scammers are stealing documents from mailboxes and dumpsters for utility bills, credit card offers, tax forms, and other documents that can be used for identity theft or account fraud.

What This Means for Businesses: If your business sends sensitive documents by mail or handles client paperwork, your clients are at risk. You can encourage clients to go paperless to help stop the theft of important physical documents.

It’s also important to train employees on safe document handling and disposal practices, including the shredding of documents with sensitive client data.

Click here to download the report.

The Rise of AI-Powered Scams

From deepfake videos to AI-generated phishing emails and automated robocalls, criminals are using advancing technology to scale and personalize their attacks. Deepfake videos can impersonate loved ones, celebrities, and politicians. AI-powered phishing emails can be customized to online behavior. Robo-scammers can use cloned voices and chatbots to steal personal data.

What This Means for Businesses: AI scams are sophisticated, and they can be targeting your business and your clients. Make sure clients know the importance of contacting your business through official channels. Conducting AI threat and cybersecurity awareness training for your staff also is an essential part of protecting businesses and clients.

Proactive Identity & Credit Monitoring Is Essential

Across all fraud types, the IdentityIQ report highlights a common theme: the importance of identity and credit monitoring. Early detection through continuous monitoring of financial and identity information can help significantly reduces the potential impact and cost of fraud.

Business owners are in a unique position to help protect themselves and their clients.

Businesses can implement cybersecurity training and best practices as well be proactive in preparing for a data breach. IDIQ offers comprehensive data breach protection services that can help businesses proactively prepare for cyber threats and data breaches.

Learn more about data breach protection with IDIQ.

Partnering with IDIQ also offers businesses the opportunity to extend our industry-leading services to their clients, including identity theft protection, credit monitoring, and more. These services can be a powerful value-add that not only enhances client trust but can reduce bring in commission.

Bottom Line

Fraud isn’t just a consumer issue – it can negatively affect businesses and their clients. Staying informed and vigilant is the first step to helping prevent fraud. Business owners who are prepared can set themselves apart.

From a data breach response plan to helping restore customer trust through identity and credit monitoring, IDIQ can help protect your business and your customers in the event of a data breach and fraud. Get started today to protect your business and clients.

Expanding Financial Opportunities with Rent Payment Reporting Legislation in 2025

Millions of renters in the United States face a common financial hurdle that their on-time rent payments do not contribute to their credit scores, unlike homeowners whose mortgage payments directly affect their credit scores.

This lack of credit tradeline can limit financial opportunities for renters, making it harder to secure loans, receive favorable interest rates, and qualify for mortgages. However, a legislative shift is underway with new legislation promoting financial inclusion with rent payment reporting. The 2025 Multi-Family Housing Legislation Insights Report explores how new policies, such as California’s Assembly Bill 2747 and Missouri’s House Bill 938, are making rent payment reporting a standard practice, promoting financial equity for millions.

The Credit Gap: Why Rent Payment Reporting Matters

For years, renters have been at a disadvantage in the credit system. While they often spend a majority of their income on housing, their responsible payment history has not been reflected in their credit profiles. According to an IDIQ study:

- 80% of renters want their on-time rent payments included in their credit scores.

- 95% of renters seek resources to help them build and manage their credit.

- 75% of renters would consider rent payment reporting when choosing a rental property.

Recognizing the need for financial inclusion, policymakers have begun enacting legislation that mandates landlords and property managers to offer rent payment reporting. This shift aims to provide renters with the same financial opportunities as homeowners.

Key Legislative Changes in 2025

1. California’s AB 2747: Rent Payment Reporting Becomes Law

California has taken a major step in bridging the credit gap with AB 2747, which builds upon Senate Bill 1157. Effective Jan. 1, 2025, this law requires property managers and landlords with 15 or more rental units to offer rent payment reporting to the major credit bureaus. This allows tenants to build credit histories and improve their access to financial services and better loan terms.

2. Missouri’s HB 938: A Push Toward Financial Inclusion

While Missouri’s HB 938 is still awaiting legislative approval, it aims to mirror California’s approach. If passed, it requires landlords and property manager to offer rent payment reporting credit-building opportunities for renters. The proposed law would go into effect on Aug. 28, 2025, with compliance requirements for new leases starting Feb. 1, 2026.

A Growing Trend

As more states explore similar initiatives, rent payment reporting legislation enhances credit accessibility and financial inclusion while benefiting not only residents but landlords and property manager, credit bureaus, and financial institutions as well.

Who Benefits from Rent Payment Reporting?

The impact of these legislative changes provides the following benefits:

- Renters: Gain access to improved credit scores, better loan terms, and increased financial stability.

- Landlords & Property Managers: Benefit by attracting responsible tenants and building stronger tenant relationships.

- Credit Bureaus: Gain more comprehensive financial data, which can result in more accurate credit scoring.

- Financial Institutions: Expand lending opportunities to responsible renters with improved risk assessments.

How IDIQ is Supporting This Movement

Navigating new regulations can be complex, but IDIQ simplifies compliance through automated rent payment reporting solutions. As a trusted third-party data aggregator, IDIQ offers tools to help landlords, property managers, and renters seamlessly report rent payments to credit bureaus.

Download the Full Report for In-Depth Insights

New rent payment reporting legislation is bringing financial inclusion into the credit system, allowing renters to build credit and improve their financial well-being. To explore the full impact of these legislative changes and learn how IDIQ can help, download the full 2025 Multi-Family Housing Legislation Insights Report today.

Download Now