Empower Clients, Grow Revenue

No Limit Commission

Earn recurring commissions for each active member you sign up across every platform. The more you connect, the more you earn.

CRM Integrations

Track reports, progress, and disputes seamlessly. Set up instant score alerts and become a proactive partner in their financial success.

White-Glove Service

Get guidance from a dedicated account manager, share referral links with ease, and leverage marketing materials to boost your outreach.

Our Brands, Your Solutions

Identity Theft Protection

- $1M Identity Theft Insurance*

- Fraud, Dark Web & SSN Monitoring

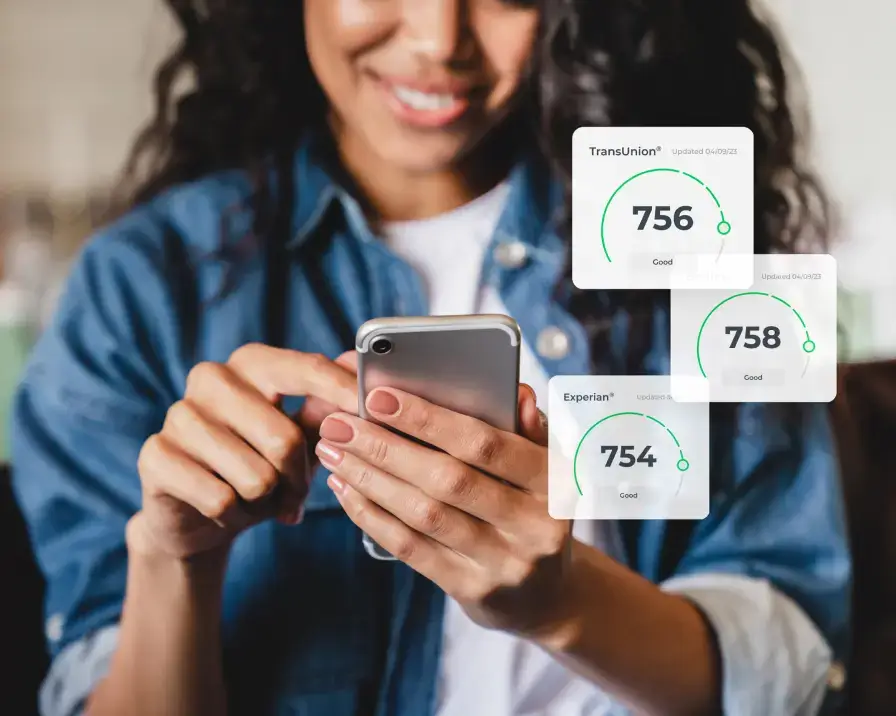

- 3-Bureau Reports & Scores

- 100% U.S.-Based Fraud Restoration Services

FICO® Credit Score Monitoring

- 3-Bureau FICO® Scores and Reports

- Real-Time Credit Monitoring & Alerts

- FICO® Score Simulator

- Mortgage, Auto & Other Industry Scores

- Identity Theft Monitoring and Protection

DIY Credit Management and Disputes

- AI-Driven Interactive Credit Analysis and Insights

- Unlimited Credit Disputes with Major Bureaus

- DIY Tools to Understand and Build Credit

- Access to 3-Bureau Credit Reports and Scores

CRM Platform

- AI-Driven Interactive Credit Analysis and Insights

- Unlimited Credit Disputes with Major Bureaus

- DIY Tools to Understand and Build Credit

- Access to 3-Bureau Credit Reports and Scores

Credit Reports, Scores & Insights

Go beyond static reports. IDIQ equips you with industry-specific scores, diverse credit models, and comprehensive reports from all three major credit bureaus. Our real-time credit monitoring provides an extra layer of protection, allowing clients to detect inaccuracies promptly. Plus, our innovative Score Simulator empowers you to show clients real-time score possibilities, fostering informed decisions and unlocking financial goals. Utilize credit alerts to guide clients toward actionable steps for achieving their ideal credit score.

Lead Monetization

The IDIQ suite of services provides valuable tools for your clients, and generate income for you even before they convert to your core credit offerings. Complement your expertise with IDIQ solutions and unlock new revenue streams while empowering clients to achieve financial well-being.

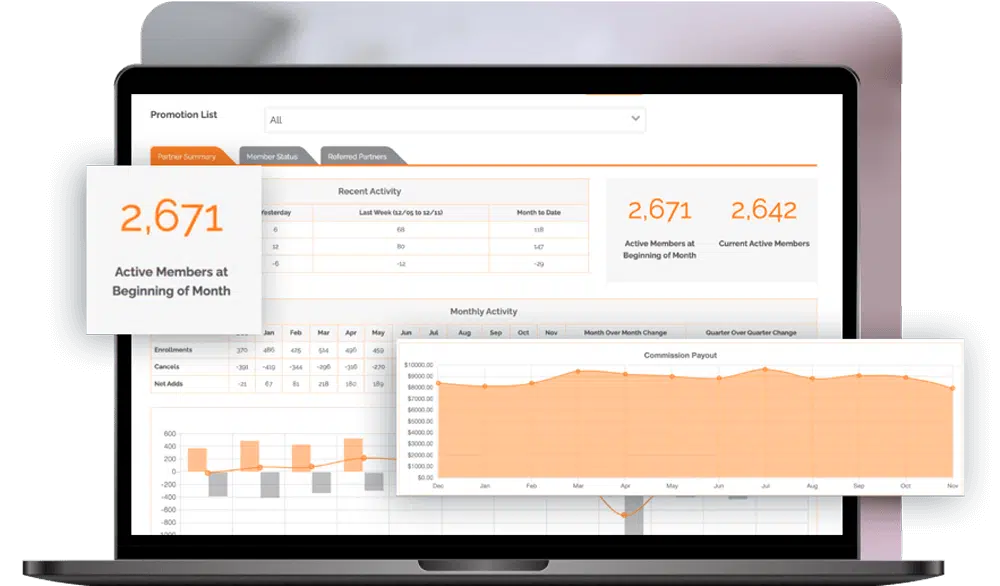

Effortless Partner Management

Stay informed and empowered with our intuitive Partner Portal. Track activity, earnings, and client progress with detailed reports. Real-time alerts notify you when a client reaches their target, allowing you to proactively guide them towards the next steps. Generate custom promo codes and leverage ready-made marketing materials, all within the portal.

HB 938: What You Need to Know About Missouri’s Rent Payment Reporting Bill

Missouri House Bill 938 (HB 938) is the first of many new rent payment reporting bills expected to be introduced over the coming months and years. Following in the footsteps of California’s AB 2747 legislation, this bill would require landlords to report on-time rent payments to credit bureaus.

This legislation aims to expand financial inclusion, helping renters build credit while creating benefits for landlords and property management companies. However, it also mandates changes in normal business practices that many landlords and multi-family housing managers may find overwhelming.

We worked with our in-house experts to break down the key impacts of HB 938, including what to expect, what is means for landlords and residents alike, and how you can stay compliant when this legislation goes into effect.

Key Takeaways

- HB 938 requires landlords to offer residents the ability to report positive rent payments to credit bureaus.

- Rent payment reporting can provide a pathway for residents to establish or improve credit scores.

- Rent payment reporting can benefit landlords by encouraging on-time payments and improving residents retention rates.

- Implementing rent payment reporting systems independently can be complex, but IDIQ offers seamless tools and resources to make compliance easier.

What is HB 938?

HB 938 is a legislative effort designed to promote financial inclusion by requiring landlords and property managers to report residents’ on-time rent payments to credit bureaus. The bill recognizes rent as a critical financial obligation and leverages it to help residents build stronger credit profiles. Rent payment reporting creates valuable tradelines tied to housing payments, which would otherwise be limited to homeowners with a mortgage.

Current Status of the Bill and Timeline

HB 938 was introduced by State Rep. Aaron Crossley to the Missouri House of Representatives first on Jan. 16, 2025, and read a second time on Jan. 21, 2025. The bill outlines specific deadlines for landlords and property management companies to comply and includes measures to ensure proper reporting practices. The bill has now been reintroduced as of December 1, 2025.

If passed, landlords would be required to start offering on-time rent payment reporting to all eligible residents.

The hearing for this bill has not yet been scheduled.

Compliance with HB 938

The primary requirement for compliance with HB 938 is for landlords and property management companies to offer residents the option to report positive rent payments to the credit bureaus. This entails setting up a system to accurately track and report on-time rental payments.

Some landlords may be exempt from the bill, such as landlords or buildings with fewer than 15 units, some corporate entities, and assisted housing developments. Landlords and property managers should familiarize themselves with the bill before its implementation to ensure full compliance.

Under HB 938, Landlords are Required To:

- Offer On-Time Rent Payment Reporting:

Landlords must provide residents the option to report their positive rental payment history to consumer reporting agencies. This option will need to be available for all leases starting at the specified bill implementation dates and must be offered annually. - Notify Residents:

Landlords are required to inform residents about the positive rent payment reporting option, including the process, potential benefits for credit building, and any associated fees. - Ensure Transparency and Accuracy:

Landlords must maintain accurate records of residents’ on-time rental payments and ensure any reported information is accurate to prevent disputes. - Comply with Fee Guidelines:

Any fee charged for rent payment reporting cannot exceed the lesser of $10 per month or the actual cost to the landlord. No fees can be charged if there are no associated costs for reporting.

Failure to pay the fee will not result in the eviction of the resident, nor be deducted from the security deposit; but the landlord may stop reporting rent payments after 30 days of non-payment. - Follow Regulations:

Follow any guidelines established by the state regarding the frequency and format of the reports.

Implementing Rent Reporting Systems

To comply with HB 938, landlords and property management companies may need to implement or enhance rent payment reporting systems. The following are some tips to help streamline the process.

- Evaluate Existing Systems:

- Review current property management software to determine whether it can handle positive rent payment reporting.

- Identify any upgrades or new tools needed to meet the requirements of HB 938.

- Select a Rent Payment Reporting Service:

- Choose a reliable service that integrates seamlessly with your property management software.

- Select providers that report to all three major credit bureaus to maximize credit-building benefits for residents.

- Integrate and Train Staff:

- Work with your rent payment reporting service provider to help ensure a smooth implementation.

- Train your team on the new procedures to guarantee timely and accurate reporting.

- Communicate with Residents:

- Notify residents about the positive rent payment reporting option, explaining how it works and its credit-building advantages.

- Provide clear instructions on how to opt in or out, along with answers to frequently asked questions.

- Address concerns proactively to encourage participation and foster positive relationships.

By following these steps, landlords and property management companies can not only comply with HB 938 but also support residents in building their credit histories through consistent rent payments.

💡 Want help offering rent payment reporting to your residents? Partner with IDIQ today.

IDIQ Tools and Resources Available to Assist in Compliance

IDIQ offers easily implementable, comprehensive rent payment reporting services to help property managers comply with HB 938. By partnering with IDIQ, landlords and property managers can make sure they meet all legislative requirements while enhancing the credit-building opportunities for their residents.

IDIQ simplifies rent payment reporting with:

- Integrated Reporting Tools: Easy-to-use software for landlords and property managers.

- Compliance Support: Ensures adherence to Fair Credit Reporting Act (FCRA) standards.

- Resident Communication Assistance: Pre-built materials to educate renters about rent payment reporting benefits.

- Automated Processes: Streamlines reporting to major credit bureaus.

Benefits of Rent Payment Reporting

While rent payment reporting won’t be required in Missouri until HB 938 passes, there are significant benefits to getting ahead of the competition and offering rent payment reporting now. Providing streamlined rent payment reporting provides advantages for property managers, residents, and the property management industry as a whole.

Benefits of HB 938 for Landlords and Property Managers

- Encouragement of On-Time Payments: Rent payment reporting motivates residents to pay rent on time, knowing their timely payments can positively impact their credit scores.

- Reduction in Resident Turnover: By offering residents a way to build their credit through rent payments, property managers can increase resident satisfaction and retention, potentially reducing turnover rates.

- Enhancement of Resident Satisfaction: Providing a rent payment reporting service demonstrates a commitment to residents’ financial well-being, fostering a stronger sense of community and trust.

⭐️ Partner with IDIQ today and stay compliant with easily implemented rent payment reporting and more.

Benefits of HB 938 for Renters and Residents

- Building Credit History: Can help renters establish or improve credit scores using positive rent payment data.

- Financial Empowerment: Can improve access to loans, credit cards, and better financial opportunities.

- Lower Security Deposits: Stronger credit profiles may reduce move-in costs such as security deposits.

Setting Up Rent Payment Reporting

Implementing rent payment reporting may feel overwhelming, especially without the proper tools and support. Here’s a quick look at the essentials and potential challenges you might encounter when managing this process independently.

The Basics

Rent payment reporting involves securely transmitting rental payment data to credit bureaus. This process requires accurate payment tracking, data security, resident authorization, and adherence to FCRA requirements.

Challenges of Setting Up Rent Payment Reporting Independently

Tackling rent payment reporting without streamlined software or professional support can cause a number of challenges, including:

- Administrative Burden: Tracking and reporting payments manually is time intensive and can be a drain on resources.

- Compliance Risks: Failing to meet FCRA standards can lead to penalties.

- Resident Communication: Effectively communicating to renters on rent payment reporting benefits can be challenging.

Given these challenges, partnering with a specialized service like IDIQ can simplify the process, ensuring compliance, accuracy, and efficiency.

Why Partner with IDIQ for Rent Payment Reporting

Partnering with IDIQ for rent payment reporting offers numerous benefits that streamline compliance with HB 938 and enhance your property management operations.

Expertise in Rent Reporting Solutions

IDIQ brings extensive experience in rent reporting solutions, helping you meet all the requirements of HB 938 effortlessly. Our expertise helps you navigate the complexities of the legislation, providing peace of mind and allowing you to focus on managing your properties.

Professional Support

IDIQ provides continuous support throughout the implementation process. From initial setup to ongoing management, our team is dedicated to helping you succeed. We offer training, resources, and personalized assistance to ensure your rent reporting system operates smoothly.

Commitment to Helping Property Managers Achieve HB 938 Compliance

We aim to help you maximize the benefits of rent reporting, enhancing tenant satisfaction and retention while positioning your properties as attractive options for responsible renters.

Financial Benefits & Ancillary Income Opportunity

IDIQ can offer the highest revenue share to property management company partners. Alternatively, you have the option to forgo commission and reduce the cost of a plan for your residents, providing flexibility in how you wish to structure your partnership

Additionally, implementing rent payment reporting with IDIQ can lead to increased revenue through improved tenant retention and satisfaction. Residents who see tangible benefits in their credit scores are more likely to renew leases, reducing turnover costs and vacancies.

Compatibility with Major Accounting Platforms

IDIQ rent payment reporting solutions are designed to integrate seamlessly with major property management and accounting software platforms, helping ensure smooth implementation and minimal disruption to your existing processes.

Ease of Implementation

Our solutions are user-friendly and require minimal effort from your on-site teams. IDIQ handles the heavy lifting, allowing your staff to focus on their core responsibilities.

Marketing Collateral Provided by IDIQ

IDIQ provides marketing materials to help you communicate the benefits of rent reporting to your residents, enhancing enrollment rates and resident satisfaction.

Empowering Renters and Landlords: HB 938’s Lasting Impact

HB 938 marks a significant step toward financial inclusion in the Missouri rental market. By making rent reporting mandatory, the bill empowers renters to build credit while helping landlords and property management companies improve resident relationships and encourage timely rent payments.

Partnering with IDIQ helps ensure that both parties maximize the benefits of this groundbreaking legislation with seamless integration.

IDIQ offers comprehensive rent payment reporting services that seamlessly integrate with existing systems, ensuring compliance with HB 938 while maximizing benefits for property managers and residents. Our solutions not only help you meet regulatory requirements but also enhance operational efficiency, resident satisfaction, and financial outcomes.

Don’t wait until the last minute to start preparing. Partner with IDIQ today to ensure your property management practices are compliant, efficient, and beneficial to your residents.

Meet the author Nikki Boehle.

Rent and Utility Reporting: Alternative Tradelines are the Fastest Credit-Building Win Your Clients Aren’t Using (Yet)

If you work with borrowers on credit readiness, you’ve seen the same pattern over and over again.

A client pays rent on time for years. They pay utilities on time. Their cash flow is stable. But their credit file does not reflect that consistency in a meaningful way.

When a credit file is thin, missing positive history can be the difference between “almost there” and “not yet.”

For credit education professionals and mortgage and lending teams, this is a structural problem, not a behavioral one. Clients do the right things, but credit systems do not always capture them.

That gap is exactly why alternative tradelines are moving from niche to mainstream.

In October 2022, the Federal Housing Finance Agency (FHFA) validated two newer credit score models: VantageScore 4.0 and FICO 10T. These models are designed to incorporate additional data sources, including rent payment history, as part of a broader view of borrower behavior.

This shift creates a practical opportunity: a high-impact, low-friction way to help clients show credit-visible progress sooner, while strengthening your own business through better retention and engagement.

This guide covers:

- What “alternative tradelines" really means for client credit strategy in 2026

- Why VantageScore 4.0 and FICO 10T make this more relevant now

- Where rent and utility reporting fits in a credit improvement plan

- How to position it with clients as speed-to-impact, not a gimmick

- How to operationalize this inside a full credit improvement plan

- How IDIQ turns this into a growth lever for your practice

What are Alternative Tradelines, Really?

Alternative tradelines are payment accounts that can show up on a person’s credit report but are not “traditional” credit products like credit cards, auto loans, student loans, or mortgages.

These reflect recurring bills people already pay, rather than borrowed money.

What counts as an alternative tradeline

- Rental payments: On-time rent payments are reported to one or more credit bureaus.

- Utility payments: Electricity, gas, water, and phone

- Telecom services: Cell phone, landline, internet, and cable bills.

Why these tradelines are becoming more important now

For years, alternative tradelines lingered on the sidelines of credit conversations. Helpful in niche cases, but not central to score strategy.

That is changing.

FHFA’s validation of VantageScore 4.0 and FICO Score 10T signals a clear direction for the industry: a fuller view of borrower behavior over time.

Credit evaluation is moving toward more complete representations of financial behavior and rent, and utility history is part of that conversation. That makes rent and utility reporting a “do-now” lever.

It gives clients something tangible they can do immediately while longer-cycle strategies take effect. It also gives credit professionals something concrete to track early on: on-time payments turning into credit-visible history while the rest of the plan works in the background.

Rent reporting: a speed-to-impact lever for thin-file clients

The appeal of rent payment reporting is straightforward:

- Your client already pays rent, which is likely their largest monthly expense

- You aren’t asking them to open a new line of credit

- You are converting existing behavior into a reported, positive payment history

In a recent report from the Credit Builders Alliance (CBA), adding a positive rent tradeline has moved the needle significantly. Nearly 79% of participants experienced an increase in their credit score, with an average jump of 23 points.

Renters who started with no credit score became scorable. Subprime renters saw the biggest movement, averaging an increase of 32 points.

The takeaway? Rent reporting can add consistent on-time history to files that are light on positives, which is where early progress can be the hardest to generate.

Utility Reporting: Where it Can Help, and Setting Expectations with Your Clients

Utility bill payments don’t typically affect credit scores because most utility companies do not report on-time payments to credit bureaus.

This creates an opportunity: if a client has consistent, on-time utility payments, utility payment reporting can add additional positive payment evidence.

There are two important points to communicate to your clients clearly:

- Utility reporting may add positive history, but results vary by credit profile and scoring model.

- Not all “utility and credit” approaches are the same. Some report as tradelines, some add data to a single bureau, and some do not affect credit reports at all.

How to Position Rent and Utility Reporting with Clients

Some clients assume rent and utilities already “count.” Others worry that reporting sounds like a shortcut. Your job is to frame both as credit visibility, clarify the differences between them, and set clean expectations up front.

- Start with a simple definition

- “This takes bills you already pay, like rent and utilities, and helps that on-time history show up as credit-visible payment information. This can strengthen your file over time without adding new debt.”

- Clarify the difference between rent and utilities

- “Rent reporting is usually the primary lever because rent is typically your largest monthly payment and can add consistent on-time history.”

- “Utility reporting can be a secondary layer. Utilities do not typically show up as positive history by default, so reporting can add additional proof of stability.”

- Clarify what rent and utility reporting is not

- “This is not a promise of a specific score change, and it does not replace credit building fundamentals like on-time payments, utilization, and correcting errors.”

- “It also does not affect every scoring model or every lending decision the same way, even when the payment history appears on your credit file.”

Use language that feels responsible, not promotional- “We’re helping your credit file reflect what you’re already doing well.”

- “This is credit visibility, not a shortcut.”

- Avoid phrases that can backfire

- “This will raise your score fast.”

- “This works for everyone.”

- “This changes what lenders see immediately.”

Credit wins for clients become retention wins for your business

One of the biggest challenges in credit education and lending workflows isn’t client understanding - it’s follow-through.

Offering rent and utility reporting helps close that gap by giving clients tools they can use immediately.

This approach allows you to:

- Turn education into action: Clients are more likely to stick with a plan when there is a clear “do this next” step that is easy to implement.

- Create a consistent check-in cadence: Credit monitoring and reporting gives you structure for follow-ups, progress reviews, and early risk detection.

- Differentiate your workflow: Most professionals can explain utilization and payment history. Fewer can operationalize momentum for their clients.

There is also a simple reason this tends to improve follow-through: people want help, and they want their responsible payments to count.

According to an IDIQ study, 95% of renters say they want access to resources that help them build and manage credit, and 80% want on-time rent payments factored into credit scoring.

When clients are already motivated, the most helpful thing you can do is make the next step clear, realistic, and easy to act on.

How rent and utility reporting fit into a full credit improvement plan

Rent and utility reporting work best as a supporting layer inside a structured plan, not a one-and-done trick.

A practical way to run it: confirm, activate, and reinforce.

Confirm: Before recommending rent and utility reporting, make sure the results are clean and consistent.

- Confirm rent and utility payments are paid on time, every time

- Set expectations: this builds payment history over time, not overnight

- Use compliance-friendly language: “credit-visible proof” instead of “guaranteed score increase”

Activate: Use reporting where it has the highest chance of impact.

- Prioritize thin-file, low-history, or previously unscorable clients

- Lead with rent reporting as the primary signal, with utility reporting where it makes sense

- Introduce reporting during slower phases of a plan to maintain momentum

Reinforce: Keep it from becoming “set it and forget it.”

- Position rent reporting as a way to get credit for the biggest bill they already pay

- Layer in utilities as an extra positive signal when appropriate

- Repeat the core message clients actually remember: “We’re helping your on-time bills show up where lenders can see them

What You Can Deliver Through IDIQ

Rent and utility reporting only helps your business if clients implement it correctly. IDIQ can help.

With IdentityIQ solutions, you can give your clients access to:

- Rent reporting to help clients build credit-visible payment history from their largest monthly bill

- Utility reporting as an additional positive layer when appropriate

- 3-bureau credit reports and scores, plus 24/7 credit monitoring to track what posts and spot changes early

- Identity theft protection, including $1 million in identity theft insurance

- Credit education tools to reinforce fundamentals and improve follow-through

- If you want rent and utility reporting to actually work as a retention lever, this is the missing piece: it needs to be easy to implement, easy for clients to understand, and easy for you to operationalize alongside monitoring and score tools

Final Notes

When clients are doing everything right, but their credit still looks thin, rent and utility reporting can help their file catch up to their behavior.

It’s not magic. It’s visibility.

Unleash better credit outcomes for your clients and accelerate your business growth. Partner with IDIQ to unlock credit reports and monitoring, score tools, identity protection, and rent and utility reporting.

IDIQ is a financial wellness company. IDIQ does not provide legal advice. The information on the website is not legal advice and should not be used as such.

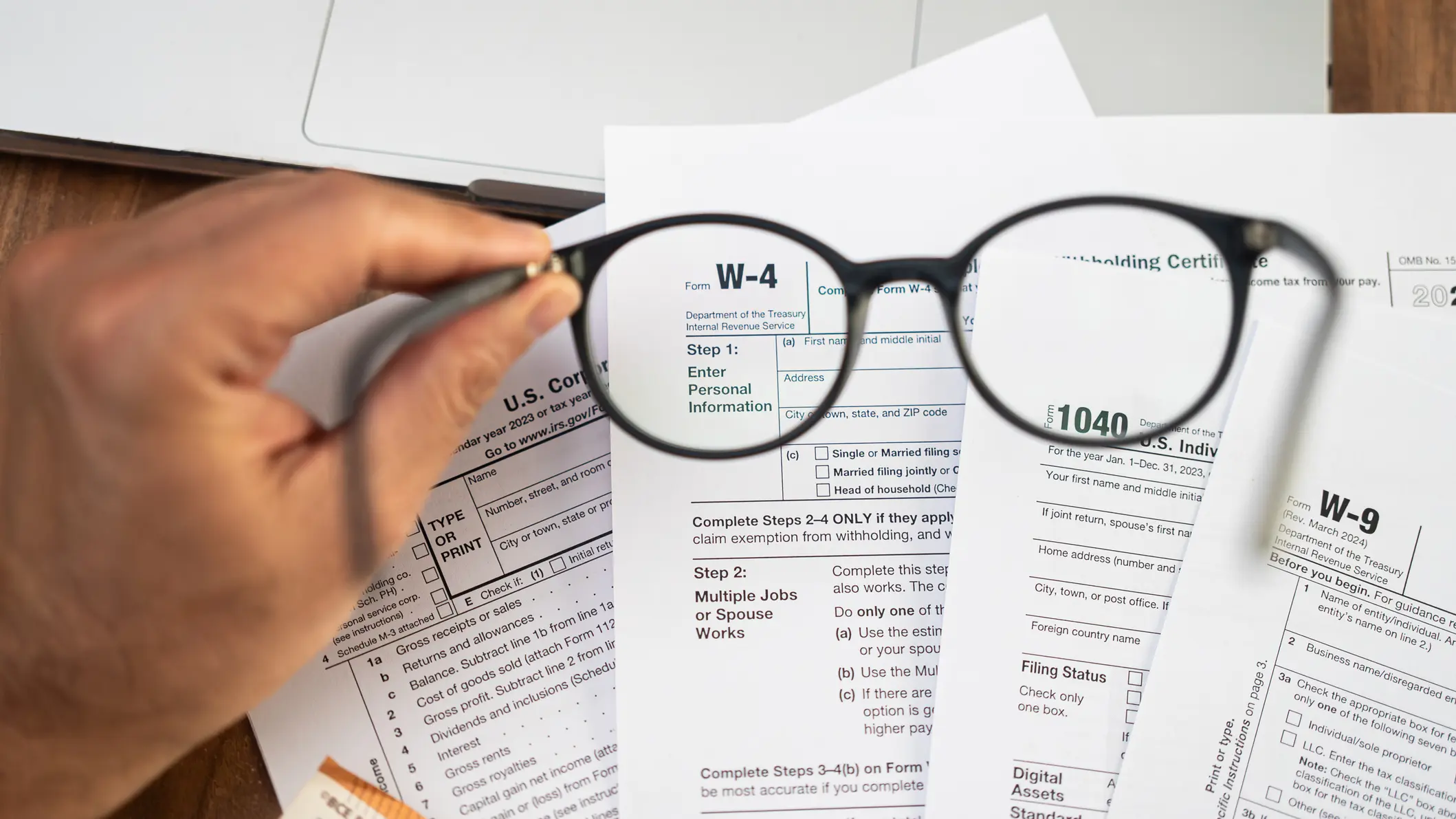

Tax Season = Scam Season: How to Protect Clients and Build Loyalty in 2026

Tax season creates a perfect storm for fraud.

Your clients are gathering W2s, 1099s, Social Security numbers, employer details, and banking information. They’re logging into accounts they rarely touch. They’re moving quickly because they want their refund.

And scammers are waiting to capitalize.

In 2024, the FTC received more than 1.1 million identity theft reports, and consumers reported more than $12.5 billion in fraud losses overall.

The risk is not just coming from complex cyberattacks. It often starts with seemingly innocent touchpoints: a text, a link, a “refund” message that looks official. In 2024 alone, consumers reported losing $470 million to scams that started with text messages.

When one bad click can cost a refund, rack up new accounts, and trigger months of cleanup, tax season becomes your moment to add protection, not just guidance.

In this article, you’ll discover:

- Why tax season is a high-risk time for identity theft and refund fraud

- A simple client action plan you can share

- The most common red flags clients should watch for

- What happens if your client is impacted

- How to use tax season to deepen relationships and drive revenue

Why Tax Season is High-Risk in 2026

Tax season creates the conditions criminals look for: a mass exchange of sensitive personal information, moving quickly across email, portals, mail, and third-party preparers.

Clients are uploading documents, responding to refund status updates, and trying to stay on deadline. Scammers try to insert themselves into that workflow.

Two patterns matter most right now:

- Refund-themed messages are a common entry point: The FTC warned in January 2026 that texts or emails claiming a refund is “processed” or “approved” often push people to click a link and enter SSNs and banking details.

- Digital impersonation spikes during filing season: The IRS warns about phishing and smishing and emphasizes that it does not make initial contact through email or social media channels.

The key takeaway is simple.

During the tax season, the risk feels real. Clients are paying attention - that makes this a natural moment to talk about protection.

A Simple Tax-Season Safety Plan for Your Clients

It helps to give your clients a clear baseline for what “safe behavior” looks like during tax season.

Encourage clients to:

- Use official refund tracking tools only: Refund status should be checked through IRS-approved resources like “Where’s My Refund?” or the IRS2go app.

- Be cautious with refund messages: Unsolicited texts or emails asking for identity or banking information should be treated as suspicious until verified through official channels.

- Set up an IRS Identity Protection PIN: An IP PIN helps prevent someone else from filing a tax return using a client’s Social Security number.

- Choose tax preparers carefully: The IRS warns against preparers who refuse to sign returns, promise unusually large refunds, or base fees on refund size.

- Secure rarely used accounts: Updating passwords and enabling multi-factor authentication is especially important for tax, payroll, and financial accounts used only once a year.

- Add credit file protection when appropriate: Fraud alerts and credit monitoring can help catch identity misuse early if tax information is compromised.

With these basics in place, clients are better prepared to spot problems before damage spreads.

Related: IDIQ Partners IDIQ Partners with Three National Tax Associations

The Most Common Tax Season Scams Clients Fall For

Tax scams aren’t always obvious. Many look-like routine financial messages or even helpful advice.

Educating your clients on the most common patterns can help them pause and verify before handing over the information needed to file a fraudulent return or steal a refund.

“Refund approved” texts and emails

These messages claim a refund is waiting and pushing the receiver to click a link to verify their identity or banking information. The FTC specifically warned about this pattern in 2026.

IRS impersonation texts or calls

Scammers pose as the IRS, using urgency, fear, and threats to push action. They may promise a “too good to be true” refund, threaten that clients must pay now or face arrest or deportation, or provide fraudulent website links that take users to harmful websites instead of IRS.gov.

Social media “refund hacks” and bad advice

Social media can be one of the most overlooked tax season risk areas, because it doesn’t look like a scam at first. It can look like financial advice, posted confidently, shared by someone who seems credible.

But bad tax advice on social media can mislead taxpayers about their credit or refund ability. In some cases, these posts are doing more than spreading misinformation; they may route taxpayers towards links that connect them directly with cybercriminals.

Tax Refund Advance Scams

Some scams exploit confusion around refund advances. Criminals steal a taxpayer’s personal information, impersonate them, and file a fraudulent return through a tax preparation service. That service then approves a refund advance based on the fake return, and the scammer routes the advance to their own accounts.

By the time anyone realizes what happened, the scammer is long gone - and taxpayers have lost refund money AND must repay the loan taken out in their name.

If your client gets hit, the worst outcome is not just the stolen refund. It’s the follow-on fraud that spreads into credit, banking, and future filings.

Related: Protecting Your Clients in the Age of Evolving Fraud

What To Do If Your Client Is Impacted by Tax Scams

This is a high-stress moment for clients. Your job is not to diagnose a tax issue. Your role is to create a clear sequence of next steps, reduce panic, and help protect their credit file from follow-on fraud.

Recommended next steps include:

- Have your client create an official identity theft report: Recommend they report the incident at IdentityTheft.gov or call the FTC. This creates documentation and a recovery plan they can follow.

- Have your client contact the IRS identity theft unit: Recommend they contact the IRS for identity theft assistance so the IRS can help address tax-account risk and identity verification steps. The IRS specifically directs identity theft victims to specialized assistance at 800-908-4490.

- If needed, file IRS Form 14039: If your client cannot e-file because a return was already filed under their SSN, IRS guidance is to file a paper return and include Form 14039.

- Protect against follow-on fraud: Tax fraud often leads to broader identity theft issues. Credit monitoring and fraud alerts help detect new activity.

- Close the loop on financial accounts: Recommend your client contact any banks and financial institutions where their accounts may be at risk, especially if the tax refund scam involved their banking details or logins.

How You Can Use Tax Season To Deepen Relationships And Drive Revenue

Tax season provides credit professionals a natural reason to check in. When protection is the focus, your outreach will feel helpful, not promotional.

Check In Proactively

Here’s a sample client message you can share:

“Subject: A quick tax-season safety reminder

Tax season is a common time for refunds and identity scams. Before you file, here are a few reminders to help protect your information:

- Use official IRS tools to check your refund

- Ignore messages asking you to click links or share personal details

- Consider setting up an IRS Identity Protection PIN

- Let me know if anything looks unusual

If you would like, we can also do a short tax-season protection review check to walk through these steps together.”

Offer a Tax Season Protection Review

A quick check-in can make all the difference. Plan time to meet with clients, providing a structured time to help them identify risks and recommend the right next steps.

Discussion items:

- Create an IP PIN plan, explaining why it matters and how to get it

- Review the top refund scam patterns they should avoid

- Scan for credit red flags: new accounts, unexpected inquiries, or address changes

- Share official refund tracking resources

Offer add-ons that inspire confidence

Credit professionals can keep support simple while still giving clients meaningful protection. One of the easiest ways to do that is to offer optional add-ons powered by IDIQ, so clients can choose the level of coverage that fits their situation.

By partnering with IDIQ, you can offer clients:

- Credit monitoring: Help clients stay aware of changes that may signal follow-on fraud, including new accounts, inquiries, or suspicious activity.

- Identity theft protection: Give clients added coverage during a season when personal data is moving fast and scams are most active.

- Family protection monitoring: Extend protection beyond the primary filer, which can matter when households share devices, documents, and financial accounts.

- Identity restoration support: Provide guided help if identity theft occurs, so clients aren’t left trying to navigate recovery steps alone.

Because tax season creates urgency and real vulnerability, clients are often more receptive to protection offerings during this window, especially when they are positioned as a practical layer of support.

Final Thoughts

Tax season is a high-risk season. Your clients are moving sensitive data quickly, and scammers are waiting to take advantage.

If you want to build loyalty in 2026, treat this time as a client protection program: a short review, a simple checklist, and a clear offer for monitoring and support.

For partners who want to turn this into a repeatable client program, IDIQ makes it easier to deliver protection at scale.

With IdentityIQ tools, partners can pair education with action, offering identity theft protection, fraud alerts, three-bureau credit monitoring, plus credit reports and score tools that help clients stay informed and protected throughout tax season and beyond.

IDIQ is a financial wellness company. IDIQ does not provide legal advice. The information on the website is not legal advice and should not be used as such.

Data Breach vs Data Leak: What’s the Difference?

When running a business, unexpected challenges come with the territory. But when those challenges involve company or client data, the stakes are far higher.

If you’ve just received an alert about something suspicious or your team is facing a flood of emails from customers asking whether their data is safe, panic can quickly set in. And before you can act, you need to know exactly what you’re dealing with. Is it a data breach or a data leak?

A data breach happens when someone intentionally breaks into your systems, while a data leak happens when information is accidentally exposed.

Both can expose sensitive information, and for small and mid-size businesses, knowing which you’re facing can help determine how you respond, how fast you act, and how you recover.

In this article, we’ll break down the differences between a data leak and a data breach, explain how each should be handled, and outline steps you can take to help protect your organization when the unexpected happens.

What is a Data Breach?

A data breach occurs when an unauthorized person or group gains access to your organization’s data or systems intentionally.

These cybercriminals are often after customer information, employee records, financial data, or credentials, and when they gain access, the damage can be catastrophic.

Common causes of data breaches include:

- Phishing emails that trick employees into sharing credentials

- Outdated software or security tools

- Malware or ransomware attacks

- Data posted in dark web forums

- Spyware

- Third-party breaches

Breaches can be costly and have lasting effects on your business reputation. Data breaches often require organizations to follow compliance requirements, send out legal notifications, and even pay costly fines — not to mention the potential loss of customer trust.

Related: 10 Tips for Data Breach Prevention

Data breach statistics show how devastating a data breach can be. In 2024, the average cost of a breach in the U.S. rose to $10.22 million, mainly as a result of regulatory fines and slower response times.

Small businesses aren’t immune to data breaches. Many attackers view small to midsize companies as ideal data breach targets, as they’re easier to infiltrate and sometimes can be leveraged as a gateway to larger entities.

The Hidden Risk of Third-Party Breaches

Data breaches can often stem from outside sources. Small businesses rely on software tools, cloud platforms, and contractors. These connections can be the pathway attackers use to reach sensitive data. Recent studies show that about one-third of breaches are linked to third-party providers. Understanding how these threats work helps companies build stronger defenses.

For example:

- Third-party breaches are widespread. SecurityScorecard reported that 35.5 % of breaches in 2024 involved vendors

- Criminals often target smaller contractors and service providers because their security measures are weaker

- One of the most well-known incidents involved Target in 2013. Hackers gained access through credentials stolen from an HVAC vendor and exposed 40 million payment cards

If your company provides a service, strong internal security protects your clients. A breach in your system can spread to other businesses and cause serious financial and reputational harm. Here are a few business security practices you can implement:

- Keep an accurate list of vendors and categorize them by risk (how much sensitive data they handle). Only 46% of organizations conduct risk assessments on vendors that handle sensitive data

- Require vendors to complete security questionnaires and follow standards such as SOC 2 or ISO 27001

- Use contracts to set expectations for security controls, multi-factor authentication, encryption, and the right to audit

- Monitor integrations and API connections for unusual activity to catch breaches early

What is a Data Leak?

A data leak is typically accidental, not malicious. It occurs when information is unintentionally exposed or made accessible to unauthorized parties, often because of human error or system vulnerabilities.

For example, an employee may send an email containing confidential company data to the wrong recipient or store unencrypted data in an unsecured cloud folder.

While unintentional, the results can be just as devastating as a breach.

Common causes of a data leak include:

- Accidental sharing of internal files or spreadsheets

- Unsecured cloud storage

- Unencrypted data

- Loss or theft of devices containing sensitive information

- Misconfigured software settings

Comparing Data Breaches and Data Leaks: Key Differences

While the terms “data breach” and “data leak” are often used interchangeably, they describe quite different scenarios.

The table below provides a clear breakdown of how leaks and breaches differ, and what each means for your business.

| Element | Data Breach | Data Leak |

|---|---|---|

| Cause | Intentional attack | Accidental exposure |

| Reason | External hackers and cybercriminals | Internal employees or partners |

| Detection | Often detected after damage occurs | Can be discovered via monitoring or audits |

| Response | Requires intensive containment and investigation | Requires securing and preventing future exposure |

While both incidents put sensitive information at risk, the intent and response differ significantly. Knowing which happened allows your data breach response team to take immediate steps to minimize impact and prevent further damage.

Data Breach vs Data Leak: Why It Matters for Your Business

When you are in the midst of a data crisis, the cause is rarely easy to spot — at least at first.

Your only signs might be strange login attempts or messages from customers that their data has been compromised. And at that moment, it can be nearly impossible to determine whether it was a targeted attack or accidental exposure.

That uncertainty can be paralyzing for business owners. While large corporations often have dedicated incident response teams, most small businesses are juggling everything else — operations, customer service, payroll — and rarely have a cybersecurity department to lean on.

And when it comes to compromised data, timing is everything. Every hour spent guessing what happened and how to respond is time that your exposed information could be spreading.

So, whether it was a breach or a leak, acting quickly is essential.

The Cost of Waiting Too Long to Respond to a Data Breach or Leak

Data breaches are often discovered long after they have occurred. According to recent research, it takes an average of 277 days to identify and contain a data breach, largely because many go undetected for extended periods.

Unfortunately, when data exposure occurs, many businesses are left unprepared. Nearly 6 in 10 small business owners assume they are too small to be targeted. This costly misconception can leave them exposed to costly data exposures.

The reality is harsh: 43% of all data breaches involve small businesses, often because limited resources and lax protocols make them easy targets. And with the average ransomware recovery cost hitting $84,000, many small businesses never recover.

Responding to a Data Leak vs. a Data Breach

Not every data leak incident is the same, so response plans should differ accordingly.

How to Respond to a Data Breach

A data breach is an active threat. Act fast, be transparent, and focus on recovery to mitigate damage.

- Containment: Disconnect any affected systems and change credentials immediately.

- Enlist a Response Team: Find data breach response solutions that can help you address vulnerabilities and restore systems.

- Follow Regulations: Ensure all notification and reporting requirements are met; noncompliance can lead to significant fines.

- Be Transparent: Be clear with your customers and employees about what happened and offer protections such as identity theft protection services.

- Review: Strengthen your response plan and implement ongoing monitoring so you can help prevent future breaches and respond faster if they occur.

Responding to a Data Leak

If you’re responding to a data leak, you are often responding to an identified risk of data exposure rather than confirmed data theft.

- Containment: First, secure your exposed data. Restrict access and remove any public links.

- Investigation: Determine the cause of the issue; whether it is human error or a system misconfiguration, document what happened.

- Process Improvement: Reconfigure settings, add safeguards, and train employees in data breach prevention to avoid future exposure.

- Notify Customers: If sensitive information was leaked, notify those affected. The more transparent you can be, the better.

- Monitor Leaked Data: Keep watch for any signs of further misuse and set up alerts for any exposure on the dark web.

Think of a data leak as a lesson — one that exposes gaps in process and training that can (hopefully) be addressed before something worse happens.

Data Breach Vs Data Leak FAQs

If you’re experiencing a data exposure, you probably have a lot of questions. Here are answers to some of the most common questions our clients have when experiencing a data breach or data leak:

1. Can a data leak lead to identity theft or financial fraud?

Yes. Although a data leak is accidental, the exposed information can still be accessed by criminals who may use it for identity theft, account fraud, or phishing scams. Even a simple piece of information, like an email address, can be utilized to create targeted attacks. This is why taking prompt action and monitoring is crucial.

2. How long does it take for a business to recover from a data incident?

Recovery time depends on the severity of the incident. A minor leak may be resolved in a few hours, while a significant breach can take weeks or even months. The recovery process includes securing systems, investigating the cause, notifying affected individuals, restoring data, and monitoring ongoing risks. Businesses that have a response plan in place typically recover much faster.

3. Are small businesses required to report data breaches or data leaks?

In most cases, yes. Many states and industries enforce data privacy laws that require businesses to notify affected individuals and, in some cases, regulators when sensitive information is exposed. Requirements can vary by state, type of data, and industry, so it is important to understand the regulations that apply to your business.

4. Does cyber insurance cover data leaks and data breaches?

Many cyber insurance policies provide coverage for both leaks and breaches, but coverage can vary by provider. Policies often include legal guidance, forensic investigation, customer notification support, data restoration, and sometimes identity theft protection for affected individuals. It is essential to review your policy details to understand what is included.

How IDIQ Helps Small Businesses Respond to Data Exposure

Whether your company faces a data breach or data leak, one thing is true: time is your most valuable asset. The faster you respond to a data exposure, the better your chances of mitigating damage, meeting legal requirements, and restoring your customers’ trust.

IDIQ offers comprehensive data breach response plans tailored to meet the needs of small and midsize businesses, including:

- Rapid response for accidental data leaks and confirmed data breaches

- Dedicated, U.S.-based support to help coordinate recovery

- Identity theft protection services for affected employees and customers

- Tailored response plans designed for your business needs

- Customer notification support to help you contact affected individuals and comply with state regulations

From response to recovery, IDIQ helps protect your organization and reputation when it matters most.

Final Thoughts

Whether your business uncovers a data breach or data leak, both require immediate attention and action.

If you suspect your data has been compromised accidentally or intentionally, contact the IDIQ data breach team today to begin your breach recovery and protect your business before it’s too late.